ETH Price Prediction: Navigating Short-Term Volatility with Long-Term Bullish Catalysts

#ETH

- Technical Positioning: ETH trades below key moving averages but approaches potential support at lower Bollinger Band

- Institutional Backing: Major investments from ETHZilla and BlackRock provide substantial fundamental support

- Ecosystem Development: Layer 2 expansion and DeFi growth continue to drive long-term value proposition

ETH Price Prediction

Technical Analysis: ETH Shows Mixed Signals Near Key Support Level

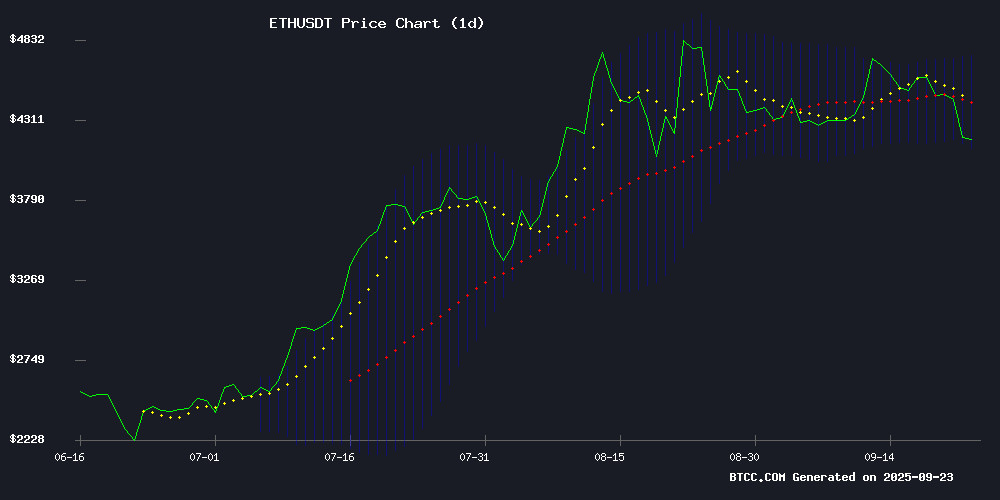

According to BTCC financial analyst Robert, Ethereum's current price of $4,199.28 sits below its 20-day moving average of $4,429.38, indicating short-term bearish pressure. The MACD reading of -64.0970 suggests ongoing downward momentum, though the narrowing gap between MACD and signal line hints at potential stabilization. Robert notes that ETH is trading near the lower Bollinger Band at $4,129.12, which could act as crucial support. "A sustained break below $4,100 WOULD be concerning, while holding above this level might trigger a rebound toward the middle band at $4,429," he stated.

Market Sentiment: Institutional Support Battles Near-Term Headwinds

BTCC financial analyst Robert observes conflicting signals from recent developments. "The $350 million commitment from ETHZilla and BlackRock's $512 million ETF investment demonstrate strong institutional confidence in Ethereum's long-term value proposition," Robert commented. However, he cautions that near-term challenges persist, citing the sharp drop in trading volume and Vitalik Buterin's ongoing clarifications about Base Network security. "While fundamental developments like Synthetix's trading competition and LAYER 2 advancements are positive, traders should monitor whether institutional inflows can overcome current technical weakness," Robert added.

Factors Influencing ETH's Price

Ethereum Price Prediction: Bullish Long-Term but Near-Term Challenges Loom

Ethereum's price trajectory remains optimistic, with analysts projecting a target of $4,983 by September 30, 2025. The bullish sentiment is fueled by the upcoming Fusaka upgrade and robust DeFi activity. However, questions linger about whether established cryptocurrencies like ETH can deliver maximum returns in September's volatile market.

Technical indicators show ETH trading at $4,175, grappling with resistance at $4,550. A breakout could propel prices toward $5,000–$6,800, while support holds at $4,000. The 50-day EMA at $4,485 serves as a pivotal level.

Institutional interest remains strong, with ETF inflows totaling $1.4 billion. Yet historical data reveals ETH's September struggles, posting median monthly returns of -12.7%. Long-term projections still envision $8,000+ if Ethereum retains its DeFi dominance, but its $382 billion market cap demands substantial inflows for significant percentage gains.

Smaller-cap projects with disruptive utility are attracting early movers, particularly in PayFi platforms built on Ethereum. As the market evolves, these emerging solutions may offer greater upside than established protocols.

ETHZilla Commits $350M to Ethereum and DeFi via Convertible Bonds

ETHZilla, a Nasdaq-listed firm pivoting from biotech to crypto, has secured $350 million through convertible bonds to deepen its Ethereum and DeFi investments. The capital will target Layer-2 scaling solutions and tokenized real-world assets, reinforcing institutional confidence in Ethereum's ecosystem.

With existing holdings of 102,000 ETH, the new funding could nearly double ETHZilla's position to 222,000 ETH—catapulting it into the top tier of corporate Ethereum holders. The move mirrors growing institutional appetite for ETH's dual value proposition: store-of-value characteristics and smart contract utility.

The company's strategic shift underscores a broader trend of traditional capital migrating toward blockchain infrastructure plays. ETHZilla's convertible bond structure offers investors optionality while providing the firm with low-cost capital to compound its crypto exposure.

ETHZilla Plans $350M Raise to Expand Ethereum Reserves and Tokenization Strategy

ETHZilla Corporation unveiled a $350 million capital raise through convertible debentures, building on its existing $156.5 million debt facility. The funding will bolster its Ethereum reserves and accelerate real-world asset tokenization initiatives. Revised terms include a 2% annual interest rate starting February 2026, with conversion priced at $3.05 per share—a 5% premium to net asset value.

The firm's yield strategy combines Layer 2 protocol deployments with traditional fixed-income exposure. "We're deploying ETH into scalable infrastructure while capturing Treasury yields," said CEO McAndrew Rudisill. ETHZilla's $500 million securities portfolio now generates compound returns across both digital and conventional assets.

Vitalik Buterin Praises Base Network as Leading Layer 2 Solution with 160 TPS and $15B TVL

Ethereum co-founder Vitalik Buterin has endorsed Coinbase's Base network as a benchmark Layer 2 solution, citing its seamless integration of Ethereum's security with enhanced usability. The network now processes 160 transactions per second and boasts nearly $15 billion in total value locked, securing its position as the second-largest Layer 2 platform.

Buterin highlighted Base's adherence to L2Beat’s Stage 1 criteria, ensuring asset security even during network disruptions. Coinbase's institutional backing has been instrumental in Base's rapid adoption, solidifying its role as a critical scaling solution for Ethereum.

The network’s design exemplifies the balance between decentralized security and efficiency—a model Buterin believes other Layer 2 projects should emulate. Base’s growth underscores the increasing demand for scalable, secure blockchain infrastructure.

Synthetix Launches $1M Perps DEX Trading Competition Ahead of Ethereum Mainnet Debut

Synthetix is set to host a high-stakes trading competition with $1 million in prizes, marking the launch of its perpetual futures decentralized exchange (DEX) on Ethereum Mainnet. The event, scheduled for October 2025, will feature 100 elite participants testing the platform's infrastructure and trading capabilities.

The competition serves as a proving ground for Synthetix's novel approach to perps trading—settling directly on Ethereum without bridges. This design enables gasless execution, low latency, and non-custodial trading while leveraging Ethereum's security. Traders can collateralize positions with sUSD, sUSDe, WSTETH, and cbBTC, maintaining market exposure while earning yield.

The launch represents a significant evolution for DeFi derivatives, combining the capital efficiency of centralized exchanges with Ethereum's decentralized settlement layer. Market makers and algorithmic traders are expected to participate heavily, given the platform's support for advanced strategies and on-chain portfolio management.

Vitalik Buterin Clarifies Concerns on Coinbase’s Base and its Security Features

Ethereum co-founder Vitalik Buterin has addressed concerns surrounding Coinbase's Layer-2 solution, Base, emphasizing its reliance on Ethereum's security infrastructure despite centralized elements aimed at enhancing user experience. Buterin clarified that Base does not control user funds, with withdrawals possible directly through Ethereum's mainnet even in the event of a network shutdown.

Coinbase plans to further decentralize Base through the introduction of a native token, aligning with broader industry trends toward reducing centralization risks. The discussion highlights the evolving balance between usability and security in Layer-2 solutions.

Sharp Drop in Trading Volume Shakes Ethereum’s Stability

Ethereum's market faces heightened fragility as trading volumes plunge, triggering severe liquidations. Leveraged positions are particularly vulnerable amid rising interest rate uncertainties and Federal Reserve decisions. Matrixport's September 23 report underscores how low liquidity amplifies risk in crypto markets.

Open interest in Ethereum futures has grown while trading activity dwindles, creating a precarious imbalance. Minor price fluctuations now cascade into aggressive sell-offs, exposing thin market depth. Seasonal volatility compounds the issue, eroding trader confidence and accelerating liquidations.

Technical breakdowns exacerbated the selloff. When Ethereum breached key support levels, algorithmic sell orders flooded the market. This accelerated the downward spiral, demonstrating how automated trading systems can amplify declines in illiquid conditions.

BitMine Secures $365 Million in Premium Stock Sale to Amplify Ethereum Dominance

BitMine Immersion Technologies has fortified its position as a heavyweight in cryptocurrency holdings with a $365 million capital raise. The Las Vegas-based firm sold 5.2 million shares at $70 apiece—a 14% premium to its September 19 closing price—to an institutional investor. Warrants for an additional 10.4 million shares could push total funding to $1.28 billion if fully exercised.

The company now controls 2.4 million ETH worth $10.9 billion, representing over 2% of Ethereum's circulating supply. Chairman Tom Lee's "alchemy of 5%" strategy aims to quintuple this position, potentially making BitMine the most influential institutional holder of ether. With $11.4 billion in combined assets including cash and investments, the firm already claims titles as the largest public ETH holder and second-largest crypto treasury globally.

BlackRock's $512M Ethereum ETF Bet Defies Market Selloff as ETH Tests $4K Support

Ethereum plunged 15% in a violent 24-hour liquidation event, wiping out $1.5 billion in leveraged positions - the largest cascade since January. Yet institutional flows tell a different story: BlackRock's spot ETH ETF absorbed $512 million in net inflows during the downdraft, signaling conviction at depressed valuations.

The second-largest cryptocurrency now battles to hold the psychologically critical $4,000 level after peaking at $4,636. Technical charts reveal stiff resistance at $4,360, with a descending trendline suggesting continued distribution. Meanwhile, the Federal Reserve's 25-basis-point rate cut and signaled dovish trajectory may rekindle risk appetite.

Is ETH a good investment?

Based on current technical and fundamental analysis, ETH presents a complex investment case. The cryptocurrency shows strong long-term fundamentals with significant institutional backing, but faces near-term technical challenges.

| Metric | Current Value | Implication |

|---|---|---|

| Price vs 20-day MA | $4,199.28 (below MA) | Short-term bearish |

| Bollinger Band Position | Near lower band ($4,129) | Oversold potential |

| Institutional Investment | $862M recent commitments | Strong long-term support |

| Trading Volume | Sharp decline | Near-term uncertainty |

According to BTCC financial analyst Robert, "Investors with longer time horizons may find current levels attractive for accumulation, but should be prepared for continued volatility in the coming weeks."